In Kenya, 70 percent of long distance payments from one individual to another are made electronically. Seventy percent of payments from governments and businesses to individuals are also made electronically. From 2006 to 2009 when M-Pesa—the Kenyan mobile instrument for all these payments—was expanding, the total number of person-to-person electronic transactions shot up rapidly, by 215 percent.

What would happen if the rest of Sub-Saharan Africa looked like Kenya? A just out from McKinsey, based on Gallup data funded by the Gates Foundation, looks into that future scenario.

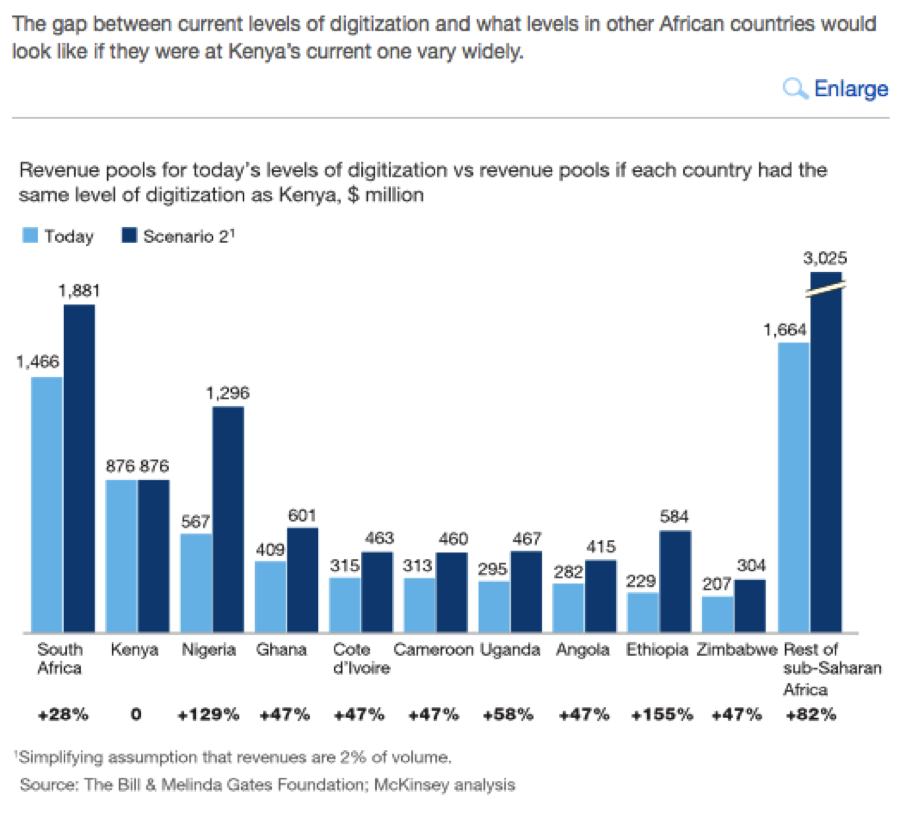

The focus of the report is the opportunity for potential payment providers to earn more revenue (estimated at 2 percent of transaction volume). Projections show revenues from electronic payments across the continent would grow 50 percent, to $15-$16 billion a year. This news comes with something of a puzzle. With the opportunity so large, why have most other countries not followed in Kenya’s footsteps?

One answer is lack of information about the market opportunity, which the report takes steps to remedy with country-level payment data, including both formal and informal channels. That’s an important step to justify the investment necessary to develop, roll-out and market digital payment platforms.

But more than anything, the report underscores that relatively low usage of digital payments is a demand, not a supply, problem. This report, as well as other research like Cost of Cash at Tufts, makes a strong case for the benefits to payers and payees of digital payments. Consumers would benefit from the convenience and relative low cost of digital payments versus dealing in cash, reducing household expenses and increasing financial inclusion. Businesses and governments would likewise enjoy reduced transaction costs. Knock-on effects could include greater government transparency and increased tax revenues.

The mismatch between plausible benefits and take-up rates suggest the need for a more nuanced understanding of demand, or lack thereof. The people at the Institute for Money, Technology, and Financial Inclusion (IMTFI) are making inroads into this topic with a synthesis of research on digital payment uptake called “Warning Signs and Ways Forward.”

IMTFI has funded over a hundred projects in the last four years, mostly carried out by researchers from the developing world. It’s great that rather than allowing these individual studies to languish on the shelf, they’ve increased the power of the body of work as a whole by sifting through them all to pull out themes and lessons that recur in studies from Kenya to India to the Philippines to Afghanistan.

Among the reasons for lagging uptake, IMTFI researchers point out that people in many countries have well-founded reasons to be wary of sharing personal information required to set up cell phone service and digital payment accounts, because of past experience of governments, political parties, tribes, or factions exploiting that information to oppress, imprison, profile, or discriminate. Recent headlines from the Ukraine provide a timely illustration of this risk: In late January, people standing near the ongoing anti-government protests in Kiev received a sinister text message: “Dear subscriber, you are registered as a participant in a mass disturbance.”

How do we overcome such issues? Of course, if we knew the answers, we wouldn’t be dealing with low take-up. The problem of a political party seizing cell phone tracking data to profile protesters is beyond the ability of providers to guard against, but regarding other risks the IMTFI report has some helpful pointers in the right direction, for example:

Be aware that subscribers in many parts of the world share phones with family and friends; be careful of designing services that assume single ownership. Avoid technological glitches; they breed mistrust. Be careful of guilt by association- don’t add on new functions to mobile platforms- like paying utility bills- without first understanding any negative customer attitudes towards the utility provider.

Download the full publication here.